Sinking in the Abyss of Loan Apps

While it might be unrealistic to require everyone to understand the deeper workings of finance, basic working knowledge is becoming imperative. The government, too, has to come up with regulations that safeguard citizens’ financial wellbeing in this cutthroat lending industry. Financial literacy should also be taught in schools, right from primary school. A healthy economy will require financially savvy citizens.

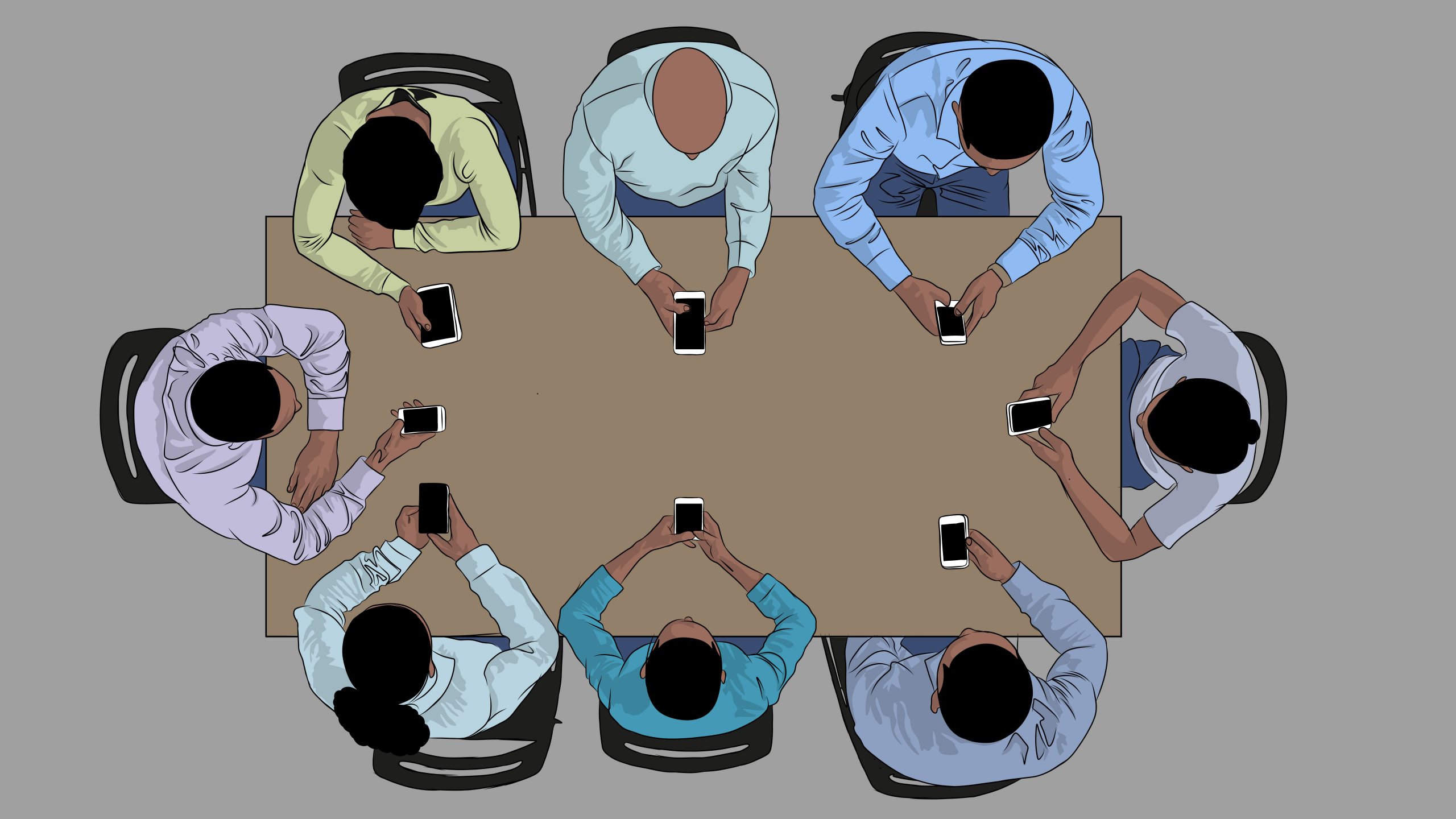

How We Came To Trust Apps

Once upon a time, you would have thought it ludicrous to send money via a mobile phone to your grandparents in the bundus, or to even order for goods online. However, all this was made possible through technological innovation on one hand, and coupled with consumer buy-in into the said innovations, such as trusting that once one ordered something online, it would be delivered in the form as advertised.

Kenya’s Debt Trap

It goes without saying that development institutions and aid agencies are here to stay, and their business is to keep loaning and giving grants. This will carry on despite the fact that loans and grants may not be used for the intended purposes. At the same time, African governments will continue insisting on their financial distress in perpetuity, as even those led by autocrats continue to receiving loans and grants. And much as national debt in and of itself is not a terrible idea, Kenya and others like her will continue struggling to breathe, until a radical fiscal shift happens.

Why You Don’t Quit As Often As You Should

The human brain tricks itself into persistence for persistence’s sake even though the writing is on the wall.

YOLO and Other Risky Stories

Choosing someone to marry can become an overly complex process. You can take the “maximizing” approach by listing pros and cons, multiplying them by their probabilities, and adding the results thereof.